CFPB Complaints and the California Insurance Crisis

Bottom Line Up Front:

- CFPB complaints are important.

- Complaint data is public and can be analyzed.

- Anticipating complaint areas is difficult, but for mortgage servicers, CA insurance would be a reasonable guess right now, which implies a focus on Reg X.

- MESH has 61 automated Reg X rules running in production today.

- It’s not just an early warning indicator. It’s a roadmap to compliance, and a demonstration to regulators of your commitment to compliance.

The CFPB uses complaints from consumers to guide its examinations of mortgage servicers in several ways:

- Identifying Patterns and Trends: The CFPB analyzes the complaints to identify common issues and trends. This helps them pinpoint specific areas where mortgage servicers may be failing to comply with regulations or where consumers are experiencing significant problems.

- Targeting Examinations: Using the patterns and trends identified, they focus on mortgage servicers that have a high volume of complaints or specific types of complaints that indicate potential violations of consumer protection laws

- Supervisory Actions: The CFPB uses the information from complaints to direct more in-depth reviews of a servicer’s practices, require corrective actions, or even take enforcement actions if necessary.

- Policy Development: Complaints also help the CFPB in developing policies and regulations.

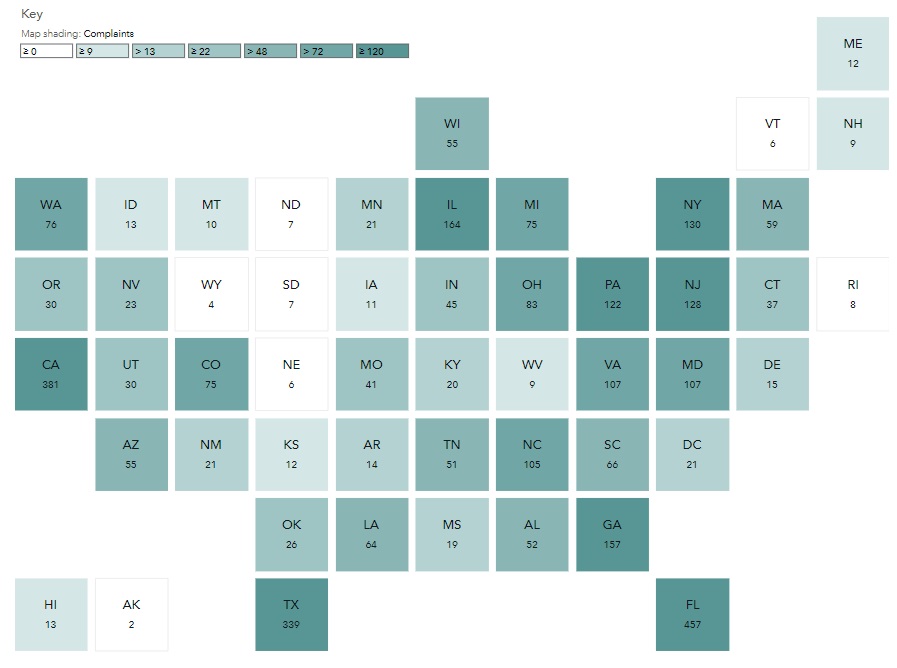

Complaint data is public and can be downloaded from the CFPB website, where you can also filter it online. You can analyze it for trends and identify the hot spots for complaints. Given the challenges in California with insurance, “escrows, taxes or insurance” ought to be a category with interesting trends. Unfortunately, the category is only about a year old, and there aren’t any obvious trends right now. CFPB’s page will let you map the data, and while that shows a lot of insurance issues in CA, it’s not worse than TX or FL on a per capita basis.

The map shows 12 months of data for “escrows, taxes and insurance” complaints by state, revealing how the 3,417 complaints appeared in the 50 states.

If, however, you estimated that Reg X, with its insurance and escrow provisions, would be a good area to focus on, you should consider MESH Auditor as the way to understand exactly how compliant your portfolio is. Running your servicing portfolio data through 61 algorithms every day will ensure that you can’t be surprised and enable you to remediate before regulators come knocking